In 2024, China's bank card industry development process, industrial chain map, market transaction status, enterprise operation situation and future prospects analysis: Credit cards have entered the stage of stock competition, and the bank card industry will accelerate the construction of innovation capacity. In this context, Wenlin Technology follows the pace of the industry, accelerating the upgrade of business card printing equipment and strengthening innovative practice.

Summary: According to the overall operation situation of the payment system announced by the People's Bank of China, in terms of bank card business, by the end of the first quarter of 2024, a total of 9.823 billion bank cards were opened nationwide, with a sequential increase of 0.37%; the average person holds 6.97 bank cards. Among them, the number of debit cards issued was 9.063 billion, accounting for more than 90% of the total number of bank cards opened. The total number of credit cards and credit cards continued to decrease by about 7 million, with a total of 759 million cards issued.

1、 Overview of the Bank Card Industry

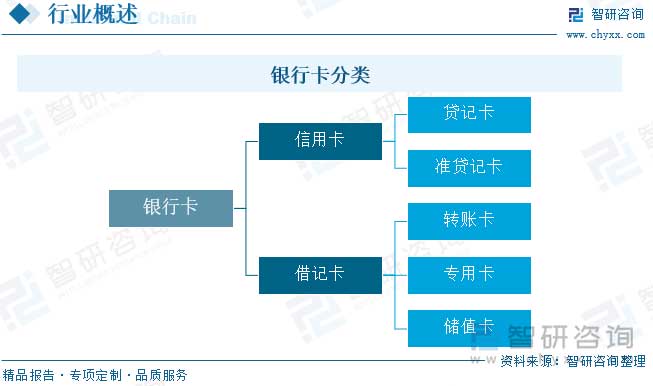

Bank card refers to a credit payment tool approved by commercial banks (including postal financial institutions) to be issued to the society, which has all or part of the functions of consumer credit, transfer settlement, cash deposit and withdrawal. Bank cards have reduced the circulation of cash and checks, allowing banking services to break through the limitations of time and space and undergo fundamental changes. The application of bank card automatic settlement system has made the dream of a "check free, cashless society" a reality. Starting from August 1, 2017, the annual fee management fee for bank cards has been cancelled, and some basic financial service fees for commercial banks have been suspended. In general, bank cards are divided into credit cards and debit cards based on whether the credit limit is granted to the cardholder. A debit card refers to a bank card issued by the issuing bank to the cardholder, which has no credit limit and the cardholder deposits first before using it. Debit cards are divided into transfer cards, dedicated cards, and stored value cards according to their different functions. A credit card refers to various media that record cardholder account information, have bank credit limits and overdraft functions, and provide relevant banking services to cardholders. According to different repayment methods, credit cards can be divided into credit cards and quasi credit cards. In addition, with the rise of digital currencies and mobile payments, China has also given birth to digital bank cards. On August 15, 2020, Baidu and Baixin Bank jointly launched China UnionPay's first digital banking card in China - Baidu QuickPass Card; On August 31 of the same year, China UnionPay released its first digital banking card, the "UnionPay Boundless Card".

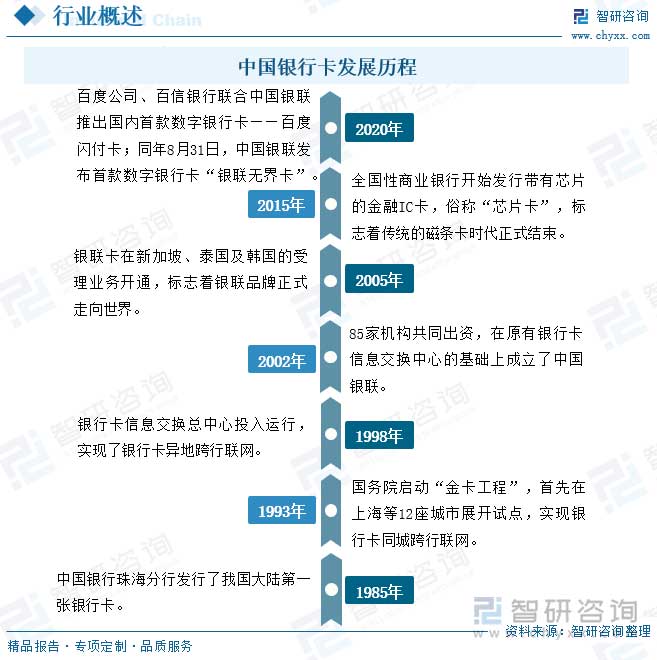

Since the 1970s, due to the rapid development of science and technology, especially the use of electronic computers, the scope of use of bank cards has continued to expand. In 1985, Bank of China Zhuhai Branch issued the first bank card in mainland China, which was a quasi credit card. Afterwards, the four major banks successively issued their own bank cards, forming the first bank card industry in China. The early bank card industry in our country was a typical closed system, where bank cards issued by different banks could not be interconnected and used interchangeably. Special merchants needed to display POS machines from each bank at the counter, which was inefficient. In June 1993, the State Council launched the "Gold Card Project", which was first piloted in 12 cities including Shanghai to achieve cross city networking of bank cards. In 1998, the Bank Card Information Exchange Center was put into operation, achieving cross regional and inter bank networking of bank cards. In March 2002, 85 institutions jointly invested to establish China UnionPay on the basis of the original bank card information exchange center, transforming the card organization from the government led "Gold Card Project" to a commercial institution. After the establishment of UnionPay, China's bank card industry developed rapidly. In January 2005, the acceptance service of UnionPay cards was launched in Singapore, Thailand, and South Korea, marking the official entry of the UnionPay brand into the world. Since January 1, 2015, national commercial banks have started issuing financial IC cards with chips, commonly known as "chip cards", marking the official end of the traditional era of magnetic stripe cards. On August 15, 2020, Baidu and Baixin Bank jointly launched China UnionPay's first digital banking card in China - Baidu QuickPass Card; On August 31 of the same year, China UnionPay released its first digital banking card, the "UnionPay Boundless Card," which achieved full process digital card application and fast card issuance, providing cardholders with a new generation of payment experience.

2、 Bank card industry chain

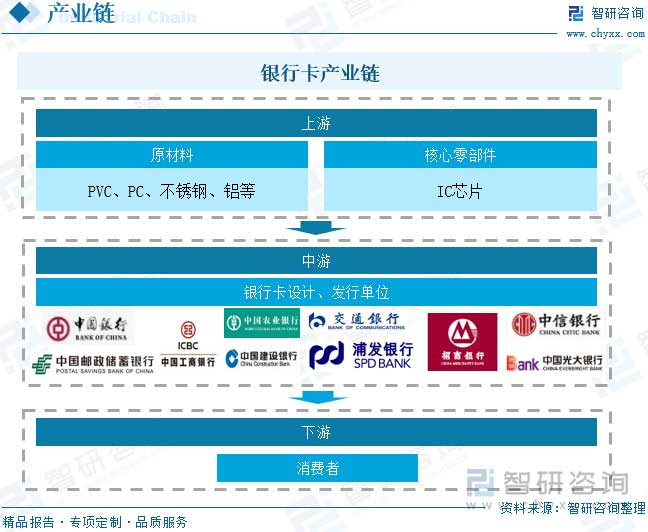

Financial IC card is a tool that highly integrates modern information technology and financial services. It adopts chip technology and financial industry standards, and can combine multiple functions such as bank card, security card, management card, etc. It has the advantages of security, convenience, standardization, and scalability. After repeated deliberation, the central bank has implemented a strategy to migrate bank cards from magnetic stripe cards to financial IC cards. From the perspective of the industry chain, the upstream of China's bank card industry chain mainly includes key components such as IC chips, as well as card making materials such as PVC, PC, stainless steel, and aluminum. The midstream is a bank card design and issuance unit, mainly consisting of financial institutions such as Bank of China, China Construction Bank, Postal Bank, and Industrial and Commercial Bank of China. Downstream is for consumers.

3、 Current Development Status of Bank Cards

Since the beginning of China's bank card business, commercial banks in various countries have attached great importance to credit card business and gradually increased their investment. Coupled with their extensive customer base and branch network, the issuance volume of state-owned commercial banks has continued to grow. However, commercial banks have adopted significant marketing efforts in the development of credit card business to attract consumers to apply for cards, and some customers have not activated their use after applying for cards, which has increased the bank's marketing and operating costs. Therefore, the credit card business of commercial banks has entered the stage of stock competition from "racing to conquer land", and the growth rate of card issuance has gradually slowed down. At the same time, the total number of credit cards in commercial banks has decreased due to factors such as regulatory strengthening and standardization of credit card business development. Currently, the credit card business of commercial banks has entered a stage of refined management, resulting in a year-on-year decline in the number of credit cards and integrated debit and credit cards issued. According to the overall operation of the payment system announced by the People's Bank of China, as of the end of the first quarter of 2024, 9.823 billion bank cards had been opened nationwide, up 0.37% month on month; The average person holds 6.97 bank cards. Among them, the number of debit cards issued is 9.063 billion, accounting for more than 90% of the total number of bank cards issued. The total number of credit cards and combined debit and credit cards continues to decrease by about 7 million, with a total issuance of 759 million cards.

From the perspective of transaction types, bank card transactions mainly include deposit, withdrawal, and consumption services. In recent years, bank card products have become increasingly diverse from debit cards to credit cards, as well as various co branded cards, theme cards, etc., meeting the needs of different consumer groups; With the advancement of payment technology, the bank card industry actively expands into emerging fields such as cross-border payments and mobile payments, providing more convenient payment experiences and promoting a stable growth trend in the bank card consumption market. In the first quarter of 2024, a total of 118.051 billion bank card transactions occurred nationwide, a year-on-year increase of 5.55%; The total transaction amount was 283.89 trillion yuan, a year-on-year decrease of 3.07%. Among them, there were 1.365 billion cash transactions with a total amount of 11.12 trillion yuan; 1.635 billion cash withdrawal transactions with a total amount of 10.94 trillion yuan; 42.085 billion transfer transactions with a total amount of 22.831 trillion yuan; There were 72.966 billion consumer transactions with a total amount of 33.52 trillion yuan. The average consumption amount of bank cards is 3412.05 yuan.

4、 Competitive Analysis of Bank Card Enterprises

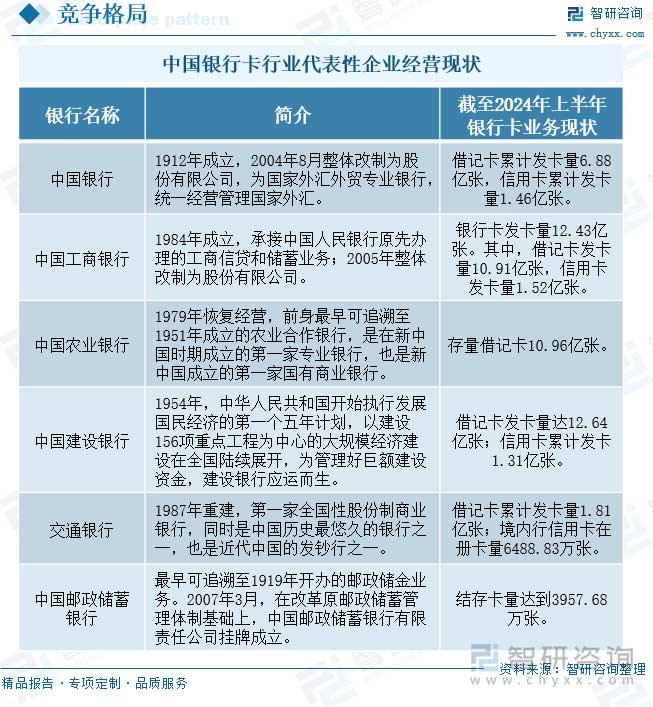

At present, the vast majority of bank cards on the Chinese market are mainly issued by financial institutions such as state-owned commercial banks, national joint-stock commercial banks, urban commercial banks, rural credit cooperatives, and rural commercial banks. Among them, the four major state-owned banks, namely Bank of China, Industrial and Commercial Bank of China, Construction Bank, and Agricultural Bank of China, occupy a large market share. With stable business models and customer trust advantages, the number of bank card issuances ranks among the top. At the same time, joint-stock banks such as China Merchants Bank, Shanghai Pudong Development Bank, and China CITIC Bank, as well as urban commercial banks, are actively launching new credit card products, continuously expanding their market share and occupying a certain market position with the advantages of more flexible product innovation and greater product discounts.

5、 Analysis of the Development Trend of Bank Cards in China

In the future, the bank card payment industry will continue to support the development of the real economy through digital capabilities. With the advancement of globalization, the cross-border and mobile payment functions of bank cards continue to enhance. UnionPay cards have been accepted in 183 countries and regions worldwide, of which 99 countries and regions support UnionPay mobile payment products. The Yunshanfu APP continues to refine its product capabilities around the dual core links of "card management" and "enjoying discounts", further meeting the diverse payment needs of the people and the real economy. Domestic bank card issuing institutions will continue to deepen their international business layout, and create a safer and more convenient cross-border payment experience by promoting interconnectivity between domestic and foreign payment networks, improving internal solutions for foreign cards, and optimizing cross-border payment rights configuration.

In addition, bank card services will tend towards diversified development. In the future, bank cards will no longer be just simple payment tools, but will gradually become an important channel for personal comprehensive financial management. On the one hand, through the strategy of deep integration of technological progress and open cooperation, all parties in the bank card industry continuously promote innovation and optimization of payment products to meet the growing needs of users. On the other hand, co branded cards with various additional services will further develop. Co branded cards are usually issued in collaboration with specific merchants or institutions, providing exclusive discounts and services to meet the needs of different consumer groups. This trend will further promote the diversified development of bank card products.

It is worth mentioning that in the future, China will continue to strengthen the reform of the financial regulatory system, coordinate and optimize the construction of the bank card payment and clearing system, and guide the healthy competition and high-quality development of the bank card industry. At the same time, regulators continue to promote open cooperation in the payment and clearing market, optimize and innovate cross-border bank card payments and overseas payment services in China, and guide financial support to expand domestic demand and promote consumption.

Source:Zhiyan Consulting